This is a beta version of the website. Thank you for visiting.

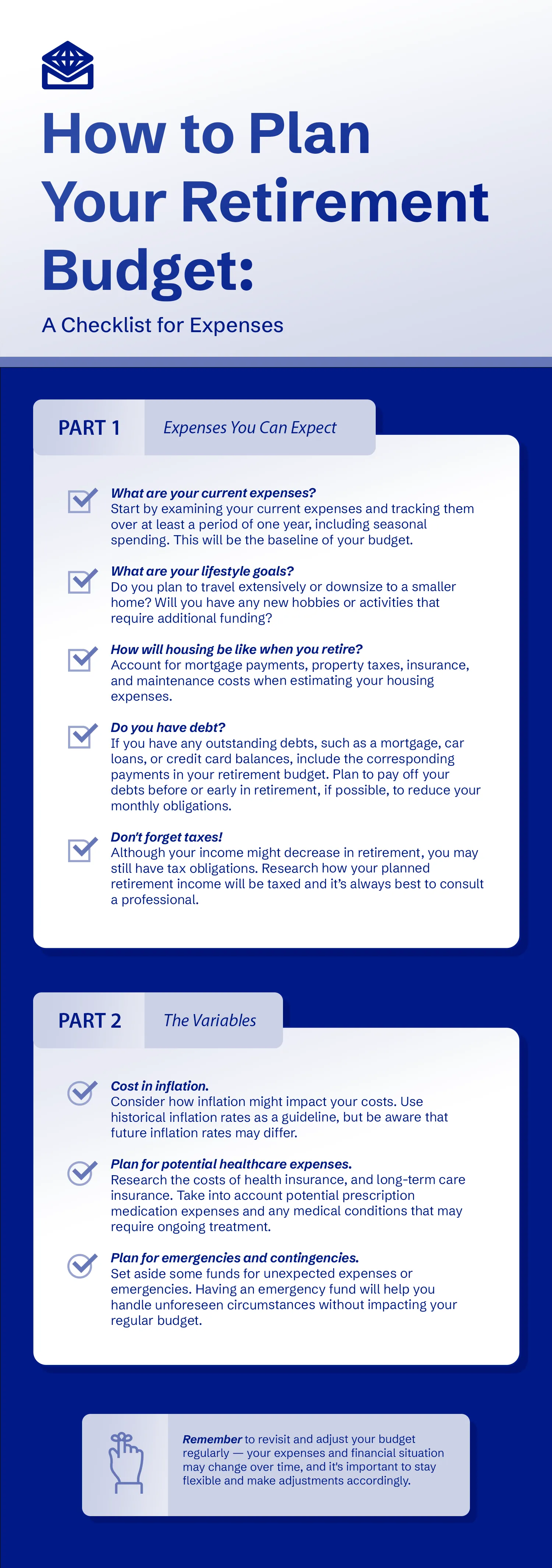

How to Plan Your Retirement Budget: A Checklist for Expenses

Planning a retirement budget is a crucial step in preparing for your future financial security. As you approach retirement, it becomes essential to evaluate your expenses, income sources, and long-term financial goals.

A well-thought-out retirement budget can help you maintain your desired lifestyle, cover your living expenses, and ensure you have enough savings to enjoy your post-work years comfortably. And this plan starts with a detailed list of your estimated future expenses. Here’s a checklist that will help you map that out.

I. Expenses you can expect

- What are your current expenses? Start by examining your current expenses and tracking them over at least a period of one year, including seasonal spending. This will be the baseline of your budget.

- What are your lifestyle goals? Do you plan to travel extensively or downsize to a smaller home? Will you have any new hobbies or activities that require additional funding?

- What will housing be like when you retire? Account for mortgage payments, property taxes, insurance, and maintenance costs when estimating your housing expenses.

- Do you have debt? If you have any outstanding debts, such as a mortgage, car loans, or credit card balances, include the corresponding payments in your retirement budget. Plan to pay off your debts before or early in retirement, if possible, to reduce your monthly obligations.

- Don’t forget taxes! Although your income might decrease in retirement, you may still have tax obligations. Research how your planned retirement income will be taxed and it’s always best to consult a professional.

II. The variables

- Cost in inflation. Consider how inflation might impact your costs. Use historical inflation rates as a guideline, but be aware that future inflation rates may differ.

- Plan for potential healthcare expenses. Research the costs of health insurance, and long-term care insurance. Take into account potential prescription medication expenses and any medical conditions that may require ongoing treatment.

- Plan for emergencies and contingencies. Set aside some funds for unexpected expenses or emergencies. Having an emergency fund will help you handle unforeseen circumstances without impacting your regular budget.

REMEMBER to revisit and adjust your budget regularly — your expenses and financial situation may change over time, and it’s important to stay flexible and make adjustments accordingly.

Retirement planning is a highly personalized process. These general guidelines should help you get started but also make sure that you cost it all out based on your unique circumstances and retirement goals. Learn more about preparing for your retirement: