This is a beta version of the website. Thank you for visiting.

Credit Cards 101: What Fees Are Charged When I Use My Card Abroad?

Credit Cards 101: What Fees Are Charged When I Use My Card Abroad?

Using your credit card abroad makes traveling more convenient and secure. Just remember that a minimal amount in the form of Cross Border Fee and Forex Processing Fee will be charged to your account when you use your credit card in stores outside of the Philippines.

1% Cross Border Fee

Represents the costs incurred to process the payment for the foreign currency transactions through the Card Network (i.e. Visa, Mastercard), acquiring bank and/or foreign merchant affiliates.

2.5% Forex Processing Fee

This represents the costs needed by Metrobank to internally process the foreign currency transactions.

How can I see the cross border fee and forex processing fee?

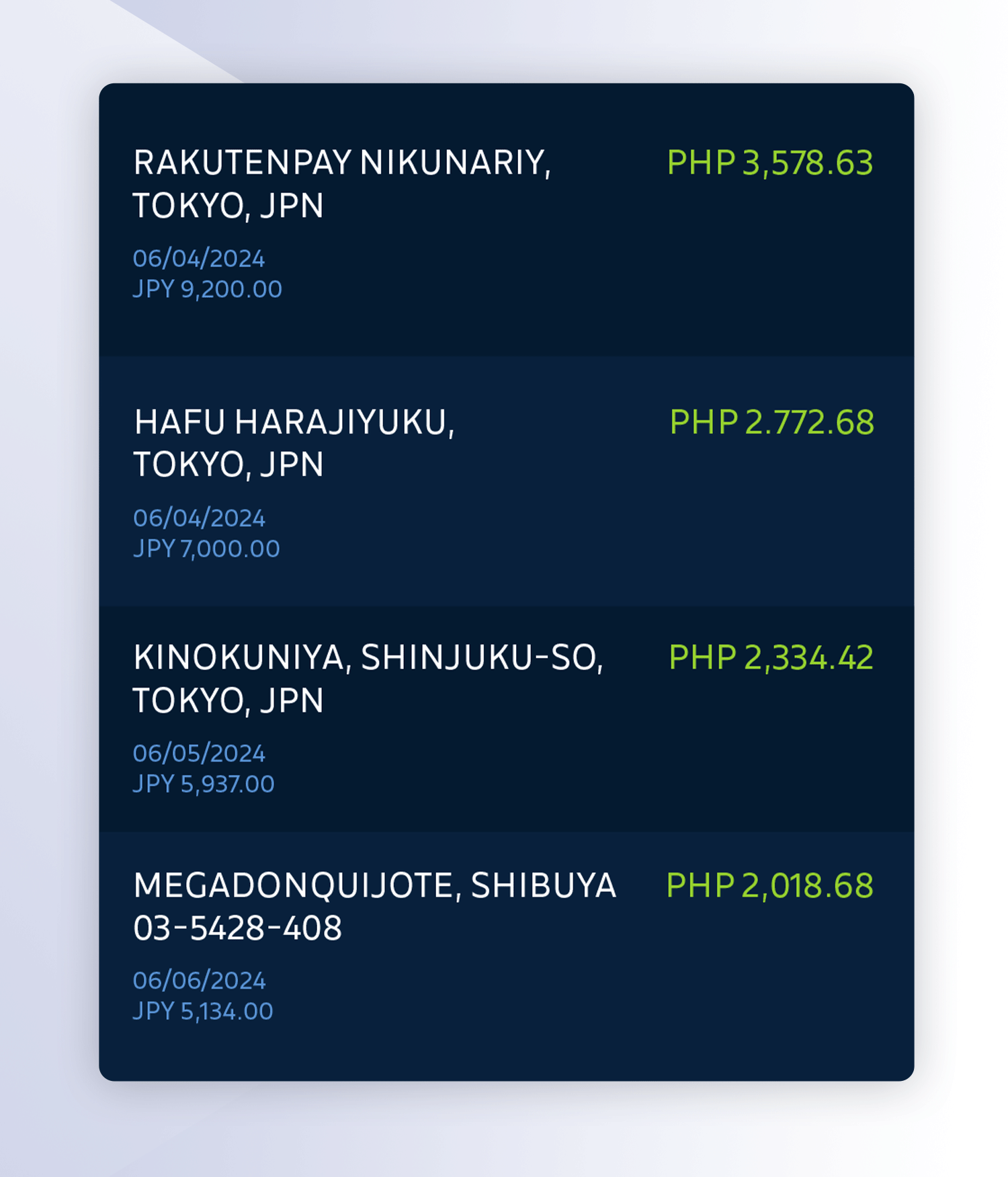

All foreign currency transactions will include the cross border fee and the forex processing fee, and will be reflected as a one line item in your transaction history both on your Statement of Account (SOA) and the Metrobank App, similar to the transactions below:

You may visit the Metrobank website to read the full terms and conditions when using your credit card abroad.

To make the most out of your credit card’s features and learn how you can avoid incurring fees, go to “Credit Cards 101″.