This is a beta version of the website. Thank you for visiting.

CREDIT3 min read

Credit Cards 101: How to Understand Your Credit Card Usage via the Metrobank App

December 20, 2024

Credit

Credit Cards 101

Understanding the different credit card terms and concepts is crucial for responsible card usage and management. Here’s a quick rundown of all the information that you’ll find on the Credit Card portion of the Metrobank App.

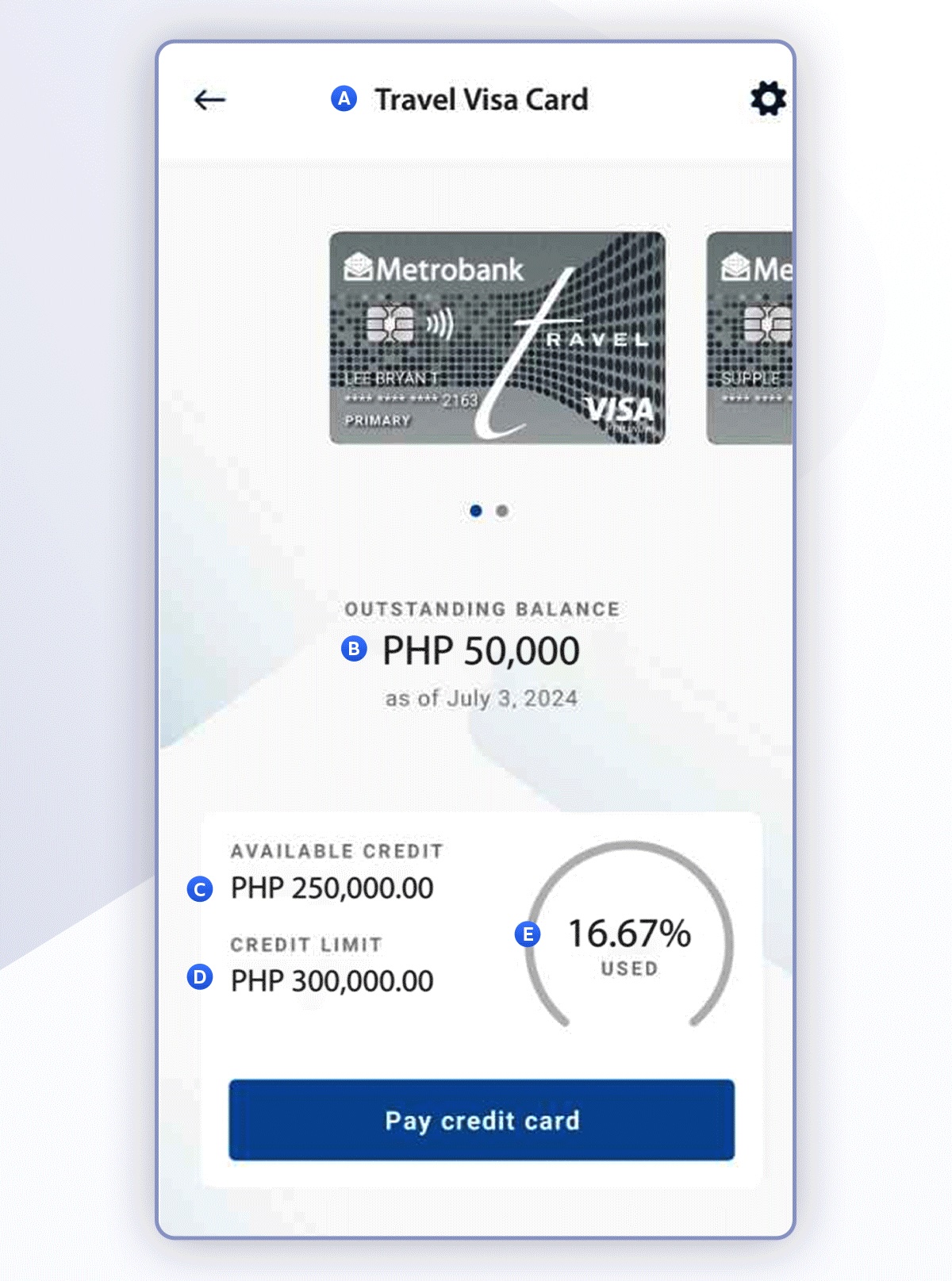

- Metrobank Credit Card Type

- Outstanding Balance

It is the amount of credit you owe the bank for the purchases made using your credit card. - Available Credit

This is the remaining amount of credit you can use without being charged an over-limit fee. This takes into consideration both posted and unposted transactions. - Credit Limit

This is your credit line or the maximum amount of money you can charge to your credit card. - Card Utilization Rate

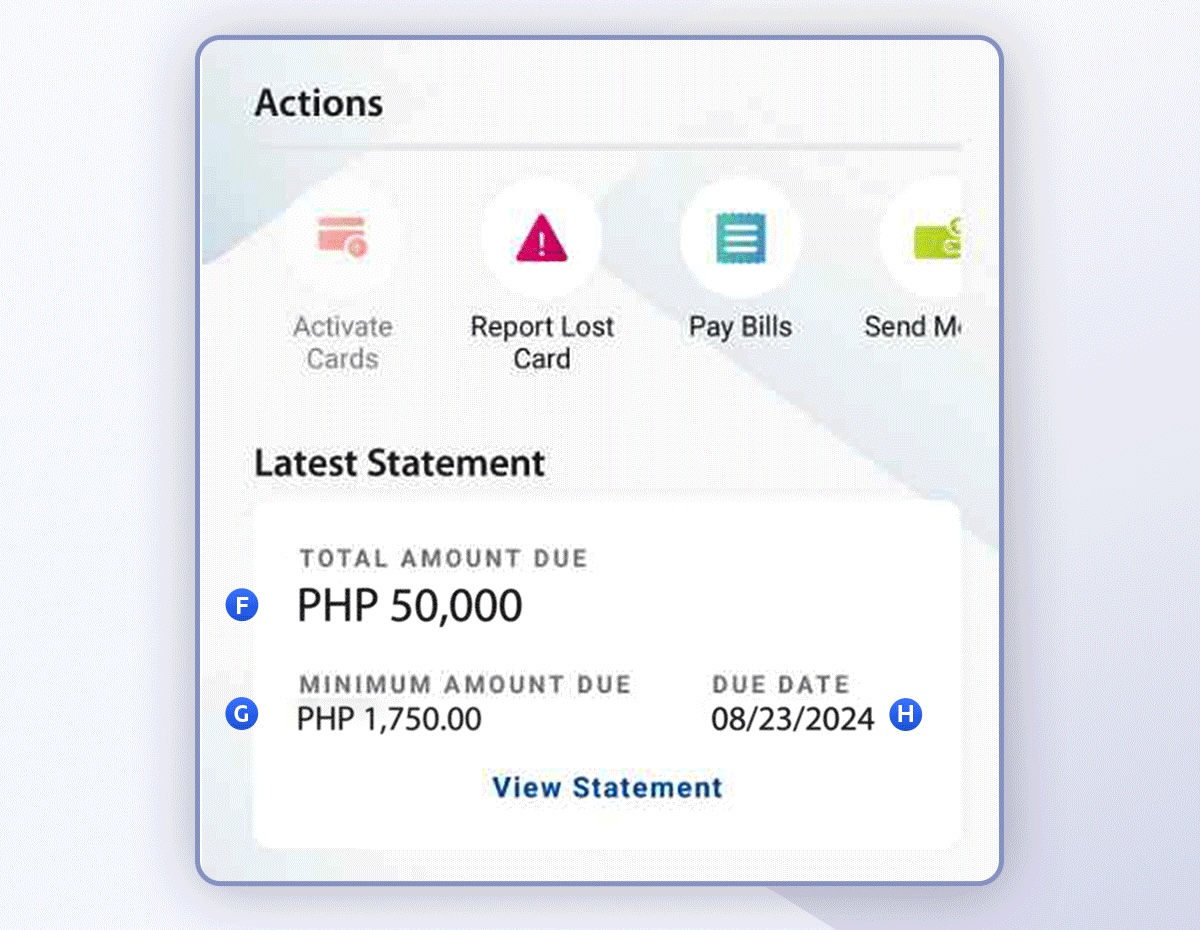

This is the percentage of your card usage versus your credit card limit. - Total Amount Due

This refers to the sum of all charges on your credit card account as of the statement period that must be paid on or before the due date. - Minimum Amount Due (MAD)

This is the lowest or minimum amount that you are required to pay on or before your payment due date to keep your account in good standing. Note that when you only pay the MAD, it also means that you’ll incur finance charges on your next statement balance. - Payment Due Date

This is the last day that you can settle your Minimum Amount Due in order to keep your account in good standing and to avoid paying late payment fees. - Card Installment Facility

Special installment features such as Cash2Go, Balance Transfer and Balance Conversion that you can avail via the Metrobank App. - View Installment Status

This portion will show you details of your special installment availment (if any), such as loan amount, tenor and monthly add-on rate. - Transaction Details

A detailed list of all posted and unposted transactions you’ve made after your last statement period.

Now that you have a better understanding of the different credit card information that you can access via the Metrobank App, you are more equipped to confidently plan for future expenses, savings, and investments.

To make the most out of your credit card’s features and learn how you can avoid incurring fees, check out the articles below.