This is a beta version of the website. Thank you for visiting.

Is work-life balance a myth?

The whole work-life balance thing hasn’t been easy for millennials.

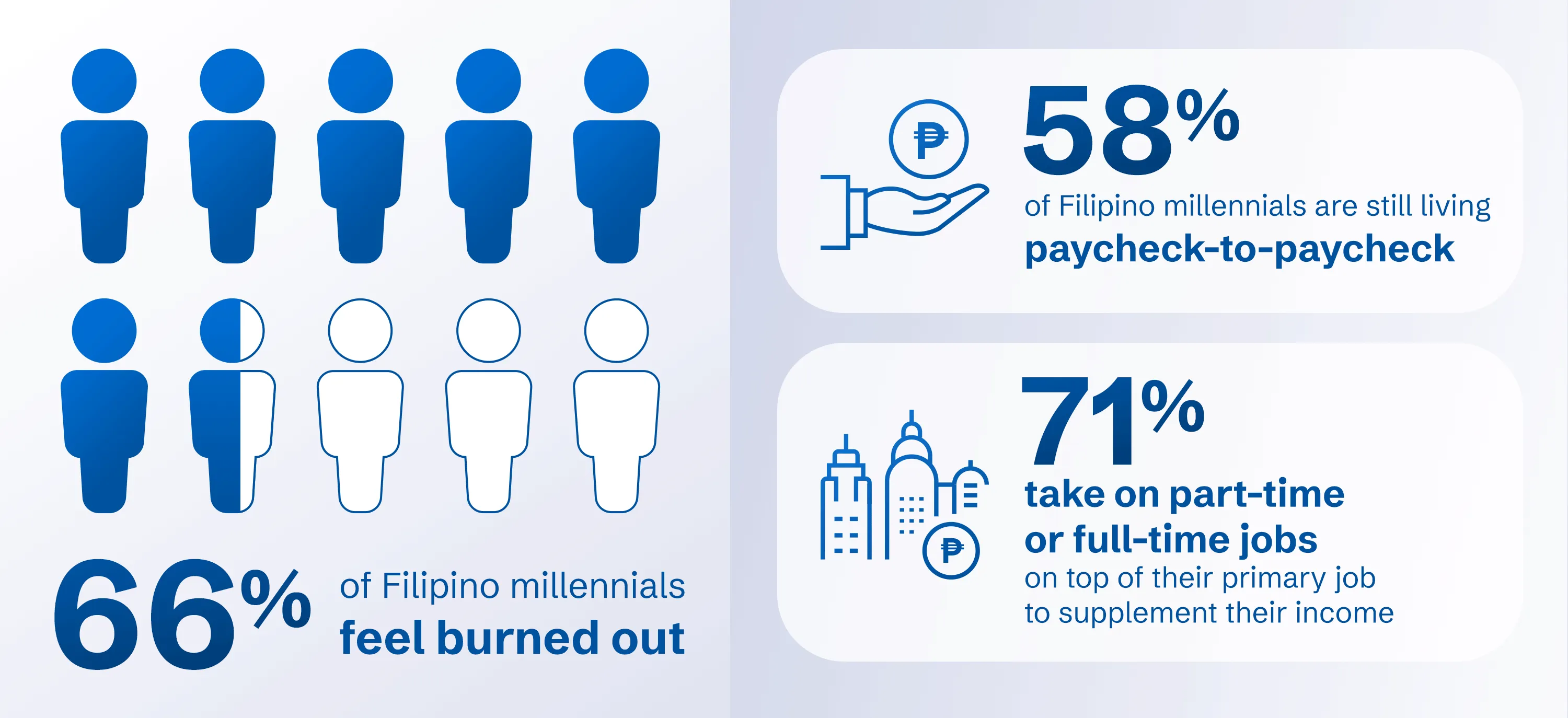

In 2023, a study found that 66% of Filipino millennials feel burned out due to the intensity and demands of their workloads, suggesting that millennials just have too much on their hands.

The same study found that 58% of Filipino millennials are still living paycheck-to-paycheck (nearly on par with the global average of 52%). This reality has largely driven 71% of Filipino millennials (compared to 37% globally) to take on either a part-time or full-time job on top of their primary job to supplement their income.

Needless to say, the pressure is real. And it’s not just the pressure to achieve and excel in your career, but to actually live the kind of life you want. The need to hustle to take care of your needs is threatening to take over your personal well-being and life satisfaction.

But, there are ways you can integrate work and life in a way that choosing one will not sacrifice the other, taking it one step at a time. Here are some ways people are doing it.

Set career and life goals side by side

Career goals are crucial, but they should coexist with personal aspirations. To foster a more balanced life, find time for things that give you joy outside of work. Set goals for hobbies, spending time with family, or personal health alongside your career and financial goals.

Take stock of your achievements

In your professional and personal development, make time to celebrate your wins, big or small. Research shows that about 82% of millennials suffer from imposter syndrome, indicating a severe lack of confidence in the work they do. Characterized as a persistent fear of “being exposed as a fraud,” imposter syndrome feels extra real when you’re burned out.

Here’s a helpful TED Talk about how you can use it to your benefit. Meanwhile, be kind to yourself and recognize achievements for what they are. Update your LinkedIn account even if you’re not looking for a new job. It also helps to build a network of mentors and peers. These relationships can provide support, guidance, and opportunities for growth in your career and life.

You should plan your finances

When you’re burned out at work and worried if you’re making enough to take care of yourself, the thought of financial planning becomes a lot more anxiety-inducing. However, you should see it as a tool or even a weapon.

It’s more than just about putting money aside and worrying about building an emergency fund. It’s about learning how you can make your money grow (without you having to take on a third job), manage your debts, and make the most out of the tools available to you.

The goal of financial planning isn’t to make you feel more anxious, it’s to pave the way to financial security. With financial security, you can have peace of mind, allowing you to enjoy your present without compromising your future. Here’s how you can start.

Work-life balance takes a bit of work. But with these steps, you can feel at ease knowing you’ll be enjoying the view as you climb the ladder. Speaking of tools, you can fast-track your goals and plan your future needs by building a good credit score with a Metrobank credit card. Click here to find the best card for you, and here to learn the fundamentals of building good credit.

Read more about how you can take charge of your financial, professional, and personal growth.